A Message From Our CEO

What People Say About Nison Candlesticks

Yeonsil.

This program was a game-changer for my trading journey! It strengthened my technical analysis skills, helping me better identify support and resistance levels and understand risk-to-reward ratios on the TradingView platform. Before this camp, I had never tried short positions, but the training gave me the confidence and motivation to develop that skill set. I truly feel more prepared and capable as a trader!

Rick.

I appreciate drilling principles of trade entry and exit, the discipline of stopping loss and taking profit, planning the trade in advance with specific targets not just in mind but on paper (drawn on screen). And the case studies are always insightful. What western indicators people use and so on. Very helpful.

Sheila.

I joined the Summer Camp because I wanted more structure and clarity in my trading. I’d often spot a good setup, but without a process I trusted, I’d either overthink it, rush in too quickly, or hesitate and miss the opportunity altogether. It felt inconsistent — and I couldn’t explain why a trade worked or didn’t. This really held me back. Using the Blueprint Form has changed the way I trade. It gives me a calm, step-by-step way to assess a chart and identify potential opportunities. I’m not relying on instinct anymore — I’m thinking through each part of the trade. The Kaizen approach has helped too — it’s shifted my mindset to focus on progress, not perfection. I’m learning to build better habits, one chart at a time. The coaching with Paul and Tim brings it all together. Listening to the case studies and group discussions helps me analyse the chart more clearly, more calmly, and with greater focus. I’m learning what matters and how to tune out the noise. I’m still building my skills, but I no longer feel I’m guessing. I approach each chart with purpose and a plan. This has changed how I trade — and made me more confident in the process.

Bill C..

Not only is getting the expertise shared by our trainers Paul and Tim so beneficial, but it was invaluable to see how the other students implemented the training concepts. Thank you all for your contributions and insights.

Daphne.

Summer Camp helped to solidify how I approach potential trades. The questions I should be asking and answering prior to entering trades. Following the Blueprint for trades is reinforcing good trade habits and I have found that brings increasing confidence to me as a trader. I love seeing all of us (students) are learning and applying the foundation of trade management. It is fascinating to see that we are working from the same foundation but also trade differently. The Summer camp helped me hone in on my style of trading. I’m so glad I took advantage of this opportunity.

Mark.

| Summer Camp, Candle Scanner and the Blueprint has been great for me. Using the Blueprint form has opened eyes to doing research and has given me a way to more objectively understand my trading strategy, and causing me to think thru the trade before I make it. Before using Candle Scanner and the Blueprint I was solely relying on scanners I found from other developers on youtube that make scanners for Think or Swim users. But, they are lacking in their level of explanation how to use the information gained from the scanner. And, the lagging effect of the information usually put me behind the move so much so that I was always going to be on the back side of the move if I took a trade, which I did on several occasions resulting in less than favorable results. Now with Candle Scanner I can not only see the moves in real time but I can also take the guess work out of the candle shapes and see what they are! Wow! what a great benefit to a beginning trader like me. and coupled with the Blueprint which give me the chance to list my strategy, indicator’s, and reasoning I have a “blueprint” at my leisure to review and see if I was correct in my assumptions, or not. Nison Candle Scanner and Blueprint has been a small investment compared to the $7500 I’ve spent in the last 9 months, on other teaching tools. It would have kept me from wasting months of time, thousands of dollars, and greatly decreased my time spent trying to get up to speed on my understanding of trading, and no doubt moved me along exponentially faster on my trading journey. No one should trade without these invaluable tools! (Use the Tools, Don’t be the Tool Fool!) |

Rick.

I appreciate drilling principles of trade entry and exit, the discipline of stopping loss and taking profit, planning the trade in advance with specific targets not just in mind but on paper (drawn on screen). And the case studies are always insightful. What western indicators people use and so on. Very helpful. Always a professional presentation and every session is helpful to me.

Kiran R..

Getting the charts reviewed by Paul and Tim. They provide improvements in our charts.

Stephan.

The Blueprint Series made it very clear that a proper preparation of your trading idea is a key factor for successful trading. The presented form helps a lot to deeply think about of some main aspeccts of trading before entering a trade. It is a very good guidance to clearly define in writing the own trading strategy. To have a strategy written down in front of you is always better than to have it only in mind and helps psychologically to stick to it.

Jonathan.

I am taking the Summer Camp program as I wanted to improve my skills in trading. I can absolutely say, that using the Blueprint Approach, I have now, finally gained the trading concepts needed to do this well. Since I started the program, I have made 4 out 4 successful, winning trades. Listening to the recordings has allowed me to pick up ideas and concepts that I never thought of before. Paul and Tim are great, and hearing case studies explained by some of the other students has really helped me. Thanks for presenting this program, and I for sure will be registering for the next programs as well!

Deependra.

| The blueprint series has provided me with a structured approach to trading and investing. It has enabled me with strategies to plan my trade end-to-end. This was something lacking in me previously and now I’m able to plan and execute my trade in a more structured way and more confidently with clarity of thought and plan. Some of my important learnings have been If-Then rule, Kaizen principle, using proxy, using ESTER for trade execution and last but not least, being SKEC-ed as a trader. Thanks to Paul and Tim for being great mentors! |

Riley.

I felt lost in my attempt at trading. I made a little money, then lost a bunch. But then my friend told me about Candlecharts. I chatted with one of the agents, and started with the Express Bundle which opened my eyes to learning how to look at charts. I then did another chat, and asked about the Blueprint Series. That might have been the best financial investment I have ever made. It took what I learned in the Express Class and put it to work. As I was taught in class, the Blueprint provided me with the structured approach that I needed, but did not even realize that it was that needed. But, I have now been consistent in my trading, and I am now a confident trader! Looking forward to taking next steps in my trading journey with Candlecharts.

Alberto P.

Recently turned to the chat team for help with charting. With their help, I made I immediate improvements to my charts. The trade I took ended up being over 50% ROI.

Roland R.

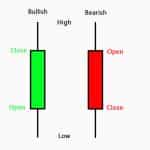

This training is very enlightening and helpful to help understand candles application to option trading.

Kristen.

I wish I found Candlecharts.com much sooner. I had wasted my time and money on other so called experts in the field. But, when I found Candlecharts, I found a team that has worked with me to make my trading dreams a reality. Started with the Express Bundle and quickly realized that I had been reading charts so wrong for so long. Then I signed up for the Small Group Coaching progression as I like being in an interactive setting. The sessions have been incredible, and for the first time I feel confident! So I have now signed up for the Trading Simulation, Nison Candle Scanner, and Market Central…and I have made much more in trading than the small investment into these programs. A big thanks to Paul who walked me thru the process, and is an excellent teacher/mentor to get me to realize my goal! Thanks Steve, Paul and team.

Sanjay.

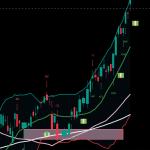

Using NCS from now almost two years, earlier in Ninja and now in Trading View, is a wonderful gift, by Sir Steve. No second thoughts while placing a trade based on candles. Thanx for Making life easy. Now, with NCS i just see, what otherwise i could have missed, though it was always in-front of you, but you cannot see everything even if you know it.

Chart Challenge under Market Central just adds to knowledge everyday.

Thanks to Sir Nison & Team, for such wonderful efforts.

Mark P.

Excellent Options Course! Brought together everything I’ve studied for the last 9 months, and the simulator trading I’ve also done.

I feel more confident in my knowledge and am ready to put my own money to work.

The instructor’s are all great, and very knowledgeable. They interacted with me and my fellow “classmates” and made this course feel “personal”.

I highly recommend it for anyone who is serious about trading options, and wondering if they are ready and knowledgeable enough to risk their own money. This course gave me the confidence boost I needed.

I will continue to seek education from Candlecharts.com!

Kiran.

I am so thankful that I found your website thru a friend. After beginning with some of your education, I decided to register for the Small Group Coaching series. Even though the time difference did not allow me to always watch live, the recordings were brilliant. The discussions led by Mr Tim and Mr Paul allowed me to see how to approach my trading like a pro. Learning and seeing in action has made me believe I can do this. Thank you Candlecharts and Mr. Steve for a great website.

Alex S.

To continue expanding my knowledge and staying updated on all aspects of trading, I made the decision to invest in multiple lifetime memberships, which include the mega package and market central.

If you’re looking for reliable and insightful resources on candle charts, I highly recommend exploring the content on candlecharts.com.

Steve’s teaching is unparalleled, offering exceptional clarity and understanding.

If you are currently contemplating the idea of learning to trade correctly, I highly recommend taking advantage of the programs that are being offered, particularly based on the valuable insights I gained from attending the small group coaching sessions.

In the past, I have undergone various training programs, but none have compared to this one and the other programs in terms of quality and accuracy.

I can confidently say that this training has provided me with a level of comfort and knowledge that surpasses anything I have experienced before.

While it may not be perfect yet, I have gained the skills and understanding needed to execute trades with confidence. The days when I used to feel uncertain or unsure about my trading strategy are begging to disappear.

I would like to express my gratitude and extend my thanks to both Paul and Tim for the exceptional training and guidance they provided.

Caylum S.

Quick replied and helpful with all I needed. Patience and couldn’t think of anywhere I’d say needs improvement. Thanks!

James L..

I registered for the Small Group Coaching series. Knowing that I was not going to be able to attend some of the sessions live, I relied on the recordings of Small Group Coaching: First Steps. So glad that I did. Paul was able to teach the concepts that I did not know, that I did not know! He made it simple for me to now be able to look at a chart with a direction…something I never had before. I will be watching the recordings again to make sure I am ready for the Next Steps program which is when I plan on starting my trading career. This is the exact information that I have been needing and did not even realize it! Thanks Paul and team for helping me to see what my future trading plan can become.

Franklin.

I heard about Steve from a friend, and wanted some practical trading training. I checked out the site, and subscribed to monthly Market Central. I watched a few sessions with Steve, Tim, Paul, and Ryan and got a couple of ideas. My first trade after the first week of watching was incredible, so I upgraded to the Mastery Collection of Mega, Nison Candle Scanner, and Market Central all with lifetime access. I am now happy to report from my seat here on the beach that I have more than paid 3 times over for my mastery collection…all in this first month! So happy! And thanks Steve and team.

HARRYS F.

MR STEVE NISON’S EDUCATION WHEN ABSORBED CORRECTLY IT ALLEVIATES ALL THE UNNECESSARY PSYCOLOGICAL STRESS WHEN TRADING . BECAUSE HIS TEACHING WORKS , AND IT IS THE ONLY ONE THAT WORKS , AND ITS COMPLETE. I CANNOT STRESS THIS ENOUGHT . IT IS COMPLETE . THE AMOUNT OF DETAIL THAT GOES IN HIS EDUCATION FOR EVERY TRADING SITUATION IS UNPARALLELED AND HE IS THE ONLY MAN FOR THIS JOB. MR STEVE NISON HOLDS THE EDUCATIONAL KNOWLEDGE TO TRADING SUCCESS.

Bob C.

I previously joined a number of very expensive training programs and learned some things, but was frustrated with methods that were like driving by looking in the rear view mirror! The methods resulted being late getting in and out resulting in missing half of the reward……..Or worse by getting in where I shouldn’t have! The big difference here is learning from the person who brought to the western world the secrets the Japanese rice traders successfully used for centuries! Steve Nison is THE GURU, of Candle Stick analysis, and a world class writer and educator who has created a team of experts who thrive on sharing their knowledge applicable to all markets. You learn the methods and practices and tools to interpret what the market is telling you in real time and how to trade it. This is like joining a family that in addition to incredible structured training provides daily access for questions and guidance. I only wish I started my trading education here, because you are learning from the best and at a great value!!!! Thank you Steve, Paul and team!!!

Clint B.

Beginner or not, I would highly encourage taking the time to get acquainted with “The Small Group Coaching Program.” It is an awesome program and offers so much valuable information regarding trading ideas and concepts. The case studies are the best for me. I like to see it with my own eyes; it really helps a lot! I say try it. I know you will benefit like I did.

Sanjay S.

Great learning. Every episode and session provides new insights

Gladys M.

Recently I took two Small Group Coaching classes. Both classes were taught by Tim Hornish and Paul Siegel. The first class was a Case Study class which has been very helpful as far as getting me thinking a little differently about what I need to do to get started in trading again. These two people have answered all my questions, for which I am very grateful. Right now I am taking another Small Group Coaching Class called Taking Action. So far it has been an exciting class. I am actually learning from the other students in the class and the case studies are what I feel will get me off the ground to trade again. I had lost most of my confidence in trading but I now believe that I will be able to trade again with education, some practice and learning the platforms. There is a definite learning curve but I can’t say enough good about Tim or Paul because no matter how many questions I or anyone else in the classes have, they are always willing to answer them and they make sure we understand. I am happy that I have done this because now I feel as if I’m on the right path of learning what I need to be a solid trader. Thank You to Steve Nison and all his trainers. And thank you, Paul, for all your patience.

Mary Jane S.

Candlecharts and the Nison Candle Scanner are THE best way to learn about candlestick trading. Period. Not only are we able to learn the art and science of reading Japanese Candlestick charts from the man who brought it to the USA, Steve Nison, but we are continuously supported throughout the process by his highly trained staff. The amount of trading knowledge that is shared is so generous that it’s mind boggling…a library full of resources and small group coaching classes that can assist anyone to get from being an insecure trader to a confident trader one in a reasonable amount of time.

Terrence N.

Steve once said the market never changes but people will always change. This was brain reset for my candle chart pattern, my trading has been easy and may you all congratulate in becoming the first millionaire forex trader in Zimbabwe.

Carl T.

Candlecharts has helped me so much in my trading techniques and skills! I have so much more confidence to make trades on my own! Thanks so much!

Stu M.

Your scanner woke me up to the candle patterns in a real world. It was eye opening.

Mark K.

NCS saves time for quicker and timelier analysis potentially leading to better trades, fewer losses, and more profitability. A tool such as this that provides quick and accurate analysis is a trader’s dream

Bernard F.

This software is your Nison candlestick trading coach. This gives the Nison Candlestick trader the ability to feel confident from day one no matter how much candlestick experience you have as a trader. Using the candlestick patterns correctly gives higher trade success.

Jake P.

It’s like trading with Steve Nison right next to you. No second guessing yourself. Forget about the cost of the software, this is a must have for any trader. If you lost money in the market then you seriously need NCS.

Yeonsil Y.

I strongly believe that candlesticks helped a lot for my trading.

Lee Z.

Candles, along with western technicals, tell the tale.

Max R.

You guys are creating the best educational trading site in the net…I love the content, information, and webinars to analyze any market….you are awesome!

Dwayne M.

Saves countless hours of analysis time and makes reacting to the developing patterns much faster… This is a great educational tool and also inspires trading confidence by having the capability of Steve’s insight right on the chart you are studying

Mark K.

I was quickly and easily able to implement all of the features of the NCS software. NCS saves time for quicker and timelier analysis potentially leading to better trades, fewer losses, and more profitability. A tool such as this that provides quick and accurate analysis is a trader’s dream.

Robert T.

“If you are tired of working for your money and you want to learn how to make your money work for you…. Steve is the man!”

Arnold P.

I think Steve is excellent…he’s very professional. He brings a very Socratic give and take approach, something you don’t see with most of the so-called mentors out there. A lot of them are charlatans, and Steve is certainly not one of them. Steve stands above the rest, without a question.

Leslie J.

I think it’s extraordinary. Steve is able to present clear-cut information that is easy to put into trading ideas. There are nuances and little pieces of information that can’t be presented in a book.

Monique M.

Without the training, I probably would have missed the candle signals and not taken my profits. I look forward to making many more successful trades in the future.

James B.

The candles allow accurate, precise, earlier entries than anything else that I am aware of … it is almost like continuously ringing the cash register.

William C.

His techniques and strategies turned my trading around. It’s very simple and deadly accurate.

John Bollinger: creator of Bollinger Bands.

Using candle charts has made me be a more profitable trader.

Jerry M.

Kris C.

The group is amazing. Not only am I learning a lot of strategies to keep in my arsenal. Even more important than that is I feel like I can trade & make mistakes & bring them to the group the next week. I’m in the learning curve & there is no better way to learn than actually taking a look at my trading, finding what I did right & wrong, & having others who have the right information feedback to me.

Peter M.

Being able to ask questions and put up trades for critique is invaluable! I highly recommend this training!

Debi W.

I have enjoyed the perspectives from different long-time traders to provide a wealth of ideas on strategy and trading. I’ve also benefited from the emphasis on risk management, candles in context, keeping a trade journal, etc. Until it becomes “second nature”, I’m in the process of creating a checklist for my trades to remember to look at the various aspects. I especially like that I can go back and listen to the sessions as many times as I want.

Heera S.

Absolutely register at Candlecharts today! This is an ever-evolving skillset and the more guidance and insight from the masters you can get, the better.

Evgenija G.

I would strongly recommend to everyone that they join Candlecharts to gain new ideas and strategies to compliment their trading.

Jim B.

The interaction with the experienced traders at Candlecharts.com has given me confidence to develop my own trading style and recognize the areas that I need to work on to improve my trading success

Jeannie B.

The content in the videos is excellent and are what I like best. The videos mean I can watch them in my own time and learn at my own pace

Mahendra B.

We learn where to find Golden Nuggets and apply them for potential rewards.

Lee G.

This is the kind of stuff new traders need to see and be involved as soon as possible. Thanks Candle Charts

Tudor P.

I found new strategies very useful and was explained very well, to understand everything.

John M.

What I learned about looking at different time frames provided an ACTIONABLE trading strategy which I implemented and MORE THAN PAID for the investment for the Course .. From swing trading just one option contract on QQQ – P304 – netted a profit of over $200 in about 15 minutes of trading time!

Disclaimer : Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Easy to Understand Training Videos to aide You in Trading/Investing for all markets including:

- Stocks/ETF's

- Options

- Forex

- Futures

- Crypto

- Indices and many others

For Every Skill & Investment Level

- Students range from ages 13 to 95!

- From traders with $100 to Wealth Management funds

- Friendly, easy-to-understand videos to guide you

- Learn to trade as a hobby, add supplemental income, or even full-time career

Learn From the Gurus of Candlecharts

- Decades of real-world experience trading & teaching candles & Western technical

- Industry leaders

- Instructors have a combined 100 years of experience!

Works In Markets Around The World

- Candle charts and trading works in all markets globally - find out how

- Currently have students in 85 countries

- Candles excel whether you trade intraday, long-term, or anywhere in between

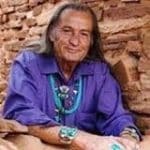

Learn From The Master:

Steve Nison

Steve Nison, CEO and Founder of Candlecharts.com was the very first to reveal candlesticks to the Western world, and is the acknowledged Western master of these charts.

-

- His three best selling books have been translated in over 20 languages.

- Over 30 years real world experience with candlesticks and Western technical analysis

- Advisor to top institutional firms

- Spoke at the World Bank, Federal Reserve and Universities

- Highlighted in the Wall Street Journal, Barrons, Euroweek and many other publications

- Winner Traders' Hall of Fame